PayPal integration

An all-in-one checkout

that adapts with your

business.

PayPal Complete Payments gives you the flexibility to upgrade at any time. Start with the features you need and add more as your business grows.

Choose the checkout

integration that’s right for

your business

Get started fast with our basic integration

Accept PayPal payments with a secure checkout experience that you can upgrade at any time. There’s less coding. Fast setup.

Included with

Standard Checkout

PayPal payment options to help boost sales

Basic customization that simplifies checkout

Built-in risk management

Steps to get

Standard Checkout

1. Sign up or log in

It all starts with a Business account. If you already have a Personal account, it’s easy to upgrade or create a new Business account.

2. Set up your account

If your account is brand new, you’ll need to verify your contact info and add your bank account before getting started.

3. Add a developer

This option requires coding, so give your developer account access. Need a developer? You can look for one in our solutions directory.

4. Code it on your site

Check out our developer resources to learn more about getting Standard Checkout up and running.

5. Start selling

You’re all set to accept payments on your website. Want more flexibility, payment options, and security? Upgrade to the Advanced Checkout integration at any time.

Pricing for

Standard Checkout

PayPal payments

Standard rate for domestic transactions. Fees are subject to change.

Card processing

Standard rate for domestic transactions. Fees are subject to change.

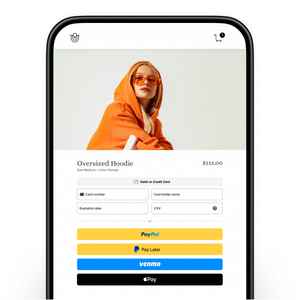

Get more ways to pay and extra branding options

Accept PayPal payments. Process credit and debit cards at a competitive rate. Offer Apple Pay®, Google Pay™️ and alternative payment methods from around the world. There’s more coding involved, but you get more control over your checkout page and additional security on eligible purchases.

Accept PayPal payments

Process card payments directly on your site

Customize your card fields and payment buttons to fit your brand

Included with

Advanced Checkout

Flexible payment methods

Customizable features

Advanced risk management

Steps to get

Advanced Checkout

1. Sign up or log in

It all starts with a Business account. If you already have a Personal account, it’s easy to upgrade or create a new Business account.

2. Set up your account

If your account is brand new, you’ll need to verify your contact info and add your bank account before getting started.

3. Apply to activate

Fill out a short form about your business so we can make sure Advanced Checkout is the best fit for you. It can take a day or two to get approved.

4. Add a developer

This option requires coding, so give your developer account access. Need a developer? You can look for one in our solutions directory.

5. Code it on your site

Check out our developer resources to learn more about how you can customize your checkout experience.

6. Start selling

You’re all set to accept payments on your website.

Pricing for

Advanced Checkout

PayPal payments

Standard rate for domestic transactions. Fees are subject to change.

Card processing and alternative payment methods

Add Chargeback Protection for an additional 0.40% per transaction.4

Interchange++ pricing available.

Standard rate for domestic transactions. Fees are subject to change.

Compare PayPal

Complete Payments integrations

| Features | Standard | Advanced |

|---|---|---|

| Accept PayPal payments (PayPal, Venmo1, Pay Later options, and Checkout with Crypto) | ||

| Credit and debit card processing (Visa, Mastercard, American Express, Discover, and more) | Processed as a PayPal payment

| Processed outside of PayPal payments

|

| Customize customer checkout flow | ||

| Apple Pay | ||

| Google Pay | ||

| Multi currency credit and debit card payment processing | ||

Alternative payment methods2

| ||

| One-time sale transactions | ||

Recurring payments

| ||

| Optimized for mobile | ||

Customer authentication

through 3D Secure

| ||

Options for full, partial, or multiple

refunds and reversals

| ||

| Track your transactions from one dashboard | ||

Automatically update customer card information with real-time account updater

| ||

| Save customer card, billing, and shipping info for fast checkout | ||

| Set up automatic transfers to your bank account | ||

Third-party network token processing

|

| Security | Standard | Advanced |

|---|---|---|

Seller Protection on eligible transactions3

| ||

Chargeback Protection4

| Optional add-on | |

Fraud Protection on eligible transactions

|

| Requirements | Standard | Advanced |

|---|---|---|

PayPal Business account

| ||

Approved application

| ||

| Developer support |

| Pricing | Standard | Advanced |

|---|---|---|

| PayPal Business account | Free | Free |

PayPal payments

| 3.49% + $0.49 fixed fee per transaction | 3.49% + $0.49 fixed fee per transaction |

| Credit and debit card payments | 2.99% + $0.49 fixed fee per transaction | 2.59% + $0.49 fixed fee per transaction |

Apple Pay and alternative payment methods4

| 2.59% + $0.49 fixed fee per transaction | |

| Add Chargeback Protection5 | + 0.40% per transaction | |

Interchange pricing (IC++)6

|

The no-code way to get paid

Easily create a link, button, or QR code for a product or service—then just copy, paste, and get paid.

Using an eCommerce platform to power your online store?

PayPal is already integrated with many popular ecommerce platforms, so you can start accepting payments right away—no coding required.

Resources

for developers

Get your API credentials, demo product experiences, and even join our developer community. Learn how to integrate our custom checkout solution and add new features as you grow.

You’re in

good company

Businesses around the world use PayPal to help their customers check out seamlessly. Our online checkout can be customized to fit your needs—even if you’re just getting started.

Frequently asked questions

More ways to

accept payments

We support businesses

just like yours

Every business needs a reliable partner. From secure payment processing to helpful business insights, we’re here for you.