Fraud and

risk solutions.

Choose the level of protection your business and customers need, and we’ll handle it from there with built-in fraud checks and game-changing adaptive machine-learning solutions.

Learn More

Fraud is evolving. Luckily, so are our solutions.

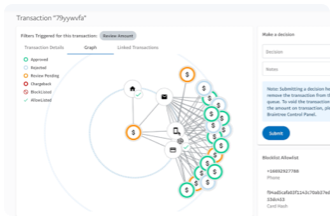

Graph View

Visually display connections to help you understand how transactions are linked through shared attributes.

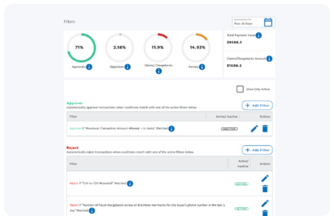

Filter Simulation

Understand the impact of filter changes and the impact of newly created filters before you activate them.

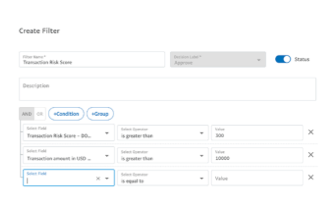

Unique Filters

Use tailored, out-of-the-box filters based on your business metrics or create your own with complex logic and custom fields.

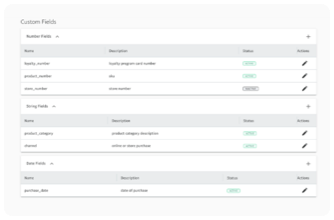

Customised Fields

Use customised (number, string, date) fields to write strategies suited for your business.

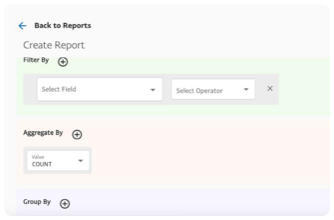

Comprehensive Reports

Build customised and high-accuracy reports that enable improved decision making and risk performance.

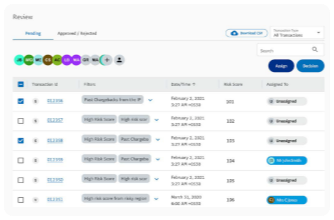

Case Management

Manage case assignment seamlessly and enable better queue management and decision making.

Fraud in numbers:

42% of online fraud incidents are chargeback fraud.1

The proof is in the payments.

Playing a major part in dispute automation.

Parts Geek is a leading online supplier of replacement auto parts and accessories — and it successfully automated and addressed 100% of disputes with help from PayPal and our Chargehound service.2 Learn how it happened and how you could also benefit.

Read more

"I knew we needed a chargeback solution that could scale with our growing business. Chargehound has increased revenue recovery and created operational efficiencies that will benefit us long-term."

Jon Sinclair, President, Parts Geek

Read Now

It pays to be in-the-know.

EBOOK

Staying ahead of fraud with PayPal Fraud Protection Advanced.

As consumer behaviour evolves, businesses must offer seamless online experiences to match. But this also provides opportunities for fraudsters – and in the face of unique challenges, PayPal is here to help enterprise businesses fight fraud in unique ways.

Learn more

REPORT

The true cost of online fraud.

This latest research reveals that organisations struggle with achieving the right balance between preventing failed transactions and having a secure payment process. Read the report to find out how to ensure secure online transactions and maintain customers’ confidence.

Learn more

We're a one-stop-shop for your business.

Enterprise solutions.

An end-to-end suite of payment solutions to help you streamline digital commerce. Powered by PayPal.

Learn more about enterprise solutions from PayPal

Global payment

processing solutions.

Help increase authorisation rates and capture lost revenue with a flexible, end-to-end payments processing platform powered by PayPal Braintree.

Learn more about global payment processing

Local payment

methods.

Allow customers to pay using their preferred local payment methods.

Learn more about local payment methods

PayPal Checkout

experiences.

Flexible, smooth payment options such as PayPal Pay Later,3 PayPal Credit,4 Venmo (in the US), and one-click payments.5

Learn more about checkout experiences

Take your payments global with PayPal.6

435M+

total active accounts

35M+

active business accounts

200+

active markets

100+

currencies

22B+

transactions in FY-22

Your business potential made possible.

Want to get started on the path to our end-to-end payments solutions?

Connect With Us

1 Ponemon Institute, Commissioned by PayPal. April 2021. Ponemon Institute surveyed 632 individuals who are familiar with their organisations’ efforts to prevent fraud and are involved in fraud investigation and mitigation and/or cybersecurity activities.

2 PayPal, Parts Geek Case study, 2022, https://www.paypal.com/us/brc/article/enterprise-solutions-partsgeek-case-study

3 PayPal Pay Later eligibility and availability is subject to merchant status, sector and integration. Consumer eligibility is subject to status and approval. Product features differ by market. See relevant product terms for more details.

4 UK PPC: FCA permission may be required to offer PayPal Credit. See terms for product details.UK mainland residents only.

5 Product eligibility and availability is subject to merchant status, sector and integration. Consumer eligibility may be subject to status and approval. Product features differ by market. See relevant product terms for more details.

6 Q4-22 Investor Update, PayPal, February 9, 2023, https://investor.pypl.com/home/default.aspx