Helping you

win at checkout

Expand reach, boost sales, and increase customer loyalty with PayPal Pay Later. 1

Book consultation

Discover PayPal's Pay Later options:

Pay in 3 and PayPal Credit

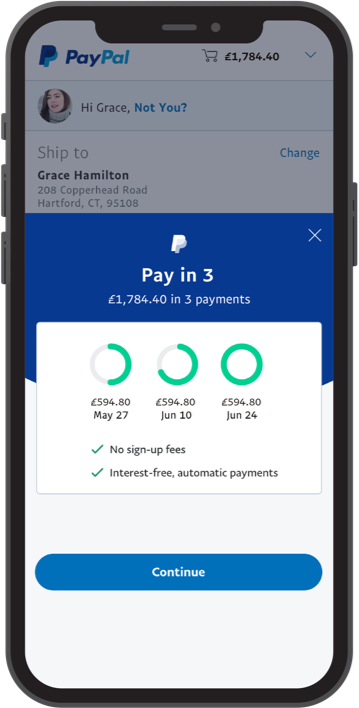

Pay in 3

When customers choose Pay in 3, they control their budget and enjoy the power to split their purchase into three interest-free payments.4

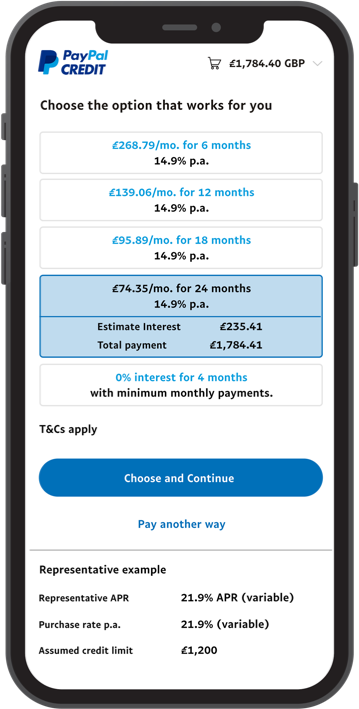

PayPal Credit

It’s quick and easy to apply for PayPal Credit. Customers get a decision instantly so, if approved, they can start shopping straightaway.5

Discover PayPal's Pay Later options:

Pay in 3 and PayPal Credit

Pay in 3

When customers choose Pay in 3, they control their budget and enjoy the power to split their purchase into three interest-free payments.4

PayPal Credit

It’s quick and easy to apply for PayPal Credit. Customers get a decision instantly so, if approved, they can start shopping straightaway.5

1 in 4 online shoppers in the UK use BNPL.6

A win for your business

Simple messaging that helps drive sales

Pay in 3 PayPal Credit For purchases £30-£2000 Reusable credit line 3 payments over 2 months 0% interest for 4 months on purchases over £99 No late fees, interest-free Monthly instalments from 6 to 48 months Included in PayPal Checkout Available in PayPal Checkout

Add banners now

Join the UK's leading brands offering PayPal Pay Later

Transforming the payment experience through innovative Buy Now, Pay Later options

PayPal has teamed up with Harvard Business Review to investigate how BNPL options can help organisations go beyond creating a better payment experience and drive true engagement with customers.

Download report

Ready to talk?

Win at checkout with Pay Later options.

Contact your Account Manager or call 020 7949 4779.

Get in touch

1. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39.

2. TRC, Commissioned by PayPal, April 2021. TRC conducted 20 minutes online survey amongst 1,000 UK consumers ages 18+.

3. TRC, Commissioned by PayPal, April 2021. TRC conducted 20 minutes online survey amongst 1,000 UK consumers ages 18+.

4. Pay in 3 is a form of credit and is not available to all merchant sectors. Pay in 3 use is subject to approval and can impact customers’ credit scores.

5. Subject to consumer status and approval. Promotion of PayPal Credit in the UK may require FCA permission

6. Buy Now, Pay Later in the UK, Bain & Company, Inc

7. Average lift in overall PayPal AOV for merchants with PayPal Credit messaging vs. those without, 2019 PayPal internal data.

8. An online study commissioned by PayPal and conducted by RFI Consulting in November & December 2020, involving 2,000 UK consumers.

9. https://morningconsult.com/most-trusted-brands-2021