How to complete your KYC To use your PayPal account, you'll have to verify your identity through the following 4 steps

KYC, which stands for 'Know Your Customer,' is a process used by fintech companies and banks to verify your identity in compliance with the Reserve Bank of India's regulations.

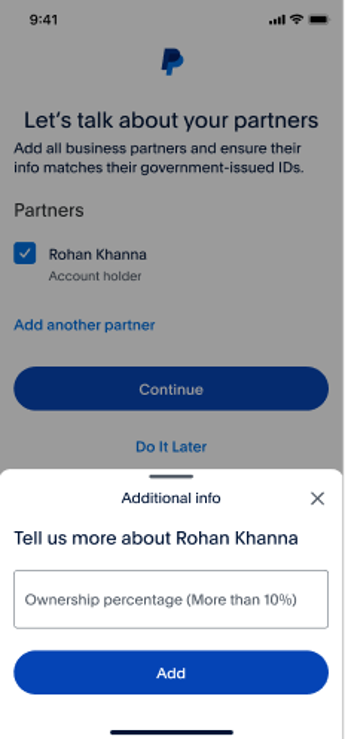

Step 1: Personal and Business information and document verification

Step 2: Bank information

To input your bank information, there are 2 methods available.

Step 3: Identity verification

The next step is to verify your identity. To proceed you have two options: you may verify your Aadhaar through DigiLocker or by manually uploading documents.

Note: You will need to allow the necessary permissions, as this is mandatory for the next step.

Step 4: Video KYC

Proceed to connect with a live video call agent for your KYC verification. Your face will be checked, and you will need to show your physical PAN card. Once the video call is completed, PayPal will verify your details within the next 2-3 days, and your account will be activated, allowing you to start using your PayPal account.

Tips: Before starting the video call, ensure your smartphone has permissions enabled for the microphone, video, and GPS. You must be located in India and avoid connecting through a VPN. Ensure you have proper lighting for facial biometric verification. Have your physical PAN card ready, making sure the name matches your PayPal account name; photocopies or laminated copies are not allowed. If you drop off during the call, you can return and resume where you left off. If you are unavailable, you can schedule a call with our agents, who are live from 7 AM pm to 10 PM IST.

Information for business account users

Businesses require documents that are not necessary for personal accounts. The documents are listed below by business type.

For more help, visit the help centre.

For more help, visit the help centre.