Payment trends to activate in 2022 and beyond

The global use of cash for in-store purchases fell by nearly a third (32.1%) in 2020.1

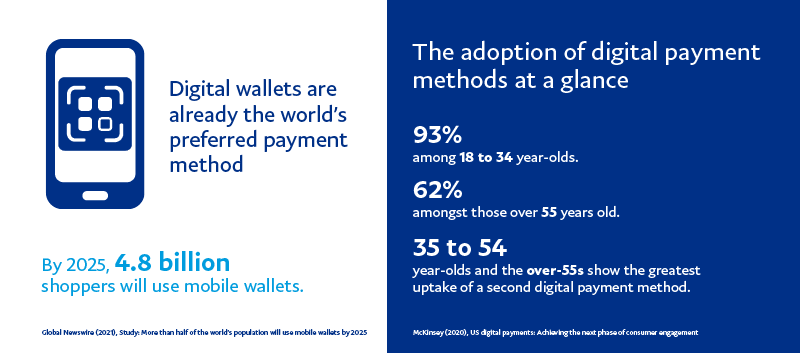

Cash is being replaced by digital wallets and other, next-generation, payment methods. The number of digital/mobile wallets in use is forecast to reach 4.8 billion (nearly 60% of the world’s population) by 2025.2

Already the world’s preferred method for online payments - with 44.5% of eCommerce transactions volume3 -, digital wallets are expected to overtake cash and cards for in-store payments.

The Asia Pacific region is a leader in the use of digital payments. Nearly half (46%) of APAC’s online population regularly uses digital wallets and, in 2020, the region accounted for 45% of total globally registered mobile money accounts.4

In 2020, Hong Kong had the world’s highest rate of mobile wallet adoption at 85% penetration rate.5

Whichever business sector you’re in, customers are quickly moving to modern ways to pay. Digital wallets, contactless payments, QR codes, instant payments and buy now pay later (BNPL) options are bringing choice, speed and convenience. What’s more, customers are quickly moving on if they don’t get the experience they expect.

What does that mean for your business?

Offer the payment choices that customers demand

The adoption of digital payment methods has been accelerated by the global pandemic and, in fast-growing markets like Southeast Asia, Latin America and Middle East & Africa, mobile wallets are already displacing cash and cards.6

As you might expect, adoption is driven by younger age groups.

Among 18 to 34 year-olds, adoption of digital payment channels has grown to 93%,7 and while adoption is only 62% amongst the over-55s, that group and the middle 35-54 year-olds show the greatest uptake of second digital payment methods.

BNPL is also popular with younger demographics and, with Generation Z comprising a global market of 2.6 billion young adults, this is an important audience for many businesses.8 In store, 5.7% of Gen-Z and 15% of millennials have used BNPL compared to just 3% of older age groups. Online behaviour is similar with 11% of Gen-Z and 26% of millennials using a BNPL option compared to 7.5% of older generations.

Looking ahead, cryptocurrencies are growing. As many as 86% of the world’s central banks are exploring the use of digital currencies.9 Global cryptocurrency transactions rose by 32% quarter-over-quarter in Q2 2021 and 45% of consumers say they are willing to use crypto payments in the next two years.10 This isn’t a 2022 issue, but businesses need to start thinking about how to meet this coming customer demand.

Rates of change and local preferences for payment and credit options are different around the world, but the direction is clear. Customers expect greater choice in payments.

Meeting those expectations is important – failing to offer customers’ preferred payment method or brand can increase online cart abandonment by between 4% and 10%.11

Businesses using PayPal can switch on additional payment methods when required, without the need for any redevelopment or reintegration of their payment solution. That makes it easy to meet – or stay ahead of – fast-changing customer expectations.

Focus on the customer experience aspect of payments

Customers are demanding a payment experience that meets their needs.

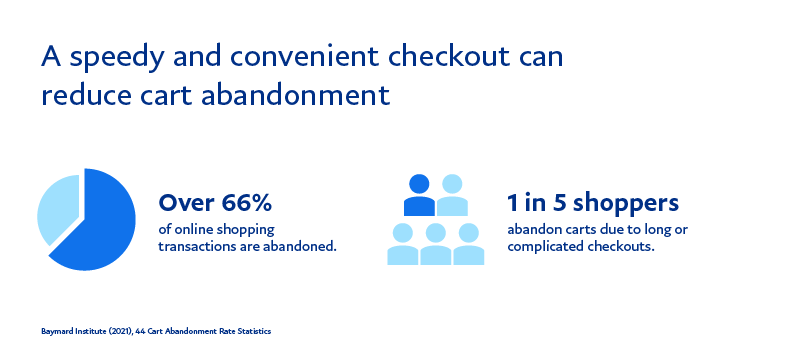

Convenience and speed are key, as the global popularity of contactless, touch-free payments shows. Online, over two-thirds of shopping transactions are abandoned and 1 in 5 shoppers say that’s because the checkout process is too long or complicated.12

Customers value the speed and simplicity of a solution like PayPal Checkout that avoids the need to re-key card numbers and personal details.

In a world of evolving expectations, it’s important for all businesses to stay agile so they don’t lose revenue to nimbler competitors. Legacy enterprise payment solutions may sometimes seem safe and stable, but too often they are slow, cumbersome and can’t accommodate new payment methods or models as easily.

Boost customer confidence and reduce fraud

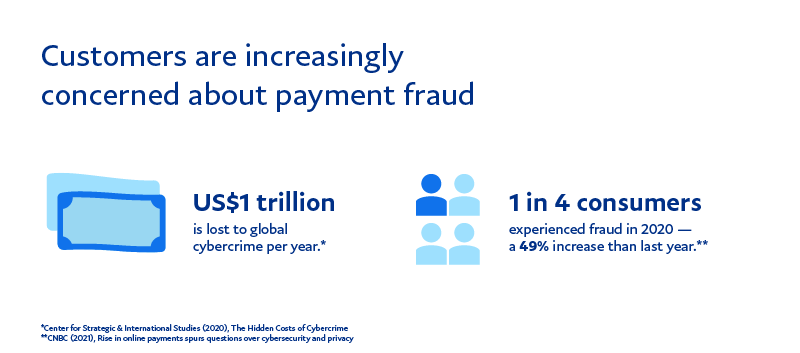

Cybercrime is big business and customers are increasingly concerned.

Global cybercrime now costs the world nearly US$1 trillion per year13 and, in a recent Mastercard survey, 1 in 4 consumers say they experienced some kind of fraud in 2020 – that’s a 49% increase over the previous year.14

Investment in fraud prevention technologies like digital ID is increasing and the requirement for additional payment authorisation steps like 3DSecure is becoming standard. The challenge for enterprises is to stay ahead of security requirements that reduce business risk and give customers confidence that their money and data are safe.

There is another consideration. A payment system that incorrectly rejects payments will mean lost revenue for the business. Having invested in bringing customers to the payment stage, they can be lost if fraud tools are too strict and reject valid payments. For large businesses, Mercator found just a 2% increase in approval rates could translate into more than a million dollars in previously unrealised revenue.

PayPal’s advanced, adaptive risk management tools may help your business reduce false rejections. PayPal uses machine-learning, trained on its huge volumes of transaction data, to enable businesses to optimise their payment approval systems. The aim being to reduce the number of falsely rejected payments and capture more revenue for the business.

Enterprises should ensure that their payment solutions use advanced analytics to optimise their payment approvals. You can also learn more about PayPal’s approach to managing fraud risk, here.

The benefits of an agile, enterprise-grade payments provider

Meeting customers’ evolving expectations is important. But providing the experience they expect, adding each emerging payment solution, and managing the associated risk of fraud can add cost and complexity to enterprise operations.

Rather than managing payment mechanisms in-house, many businesses are adopting modular payment solutions like PayPal that easily integrate with their own enterprise systems.

With a single integration, PayPal provides access to the full PayPal stack of tools, technology and data. Businesses have access to multiple payment methods used across the globe (including alternative payment methods) and can switch them on as required in the businesses’ target markets. That makes it easy to scale business across new international markets.

PayPal is also designed to provide customers with the simple, friction-free payment experience they expect, smoothing your business’ path to additional revenue. Coupled with PayPal’s use of better-quality data, more sophisticated risk scoring and optimised payment approvals, your risk of fraud may also be reduced.

With more than 400 million active customers globally, PayPal can support your enterprise with global scale, local expertise, processing capacity, and data insights. That means PayPal can help uniquely position your business to grow, compete, and thrive in today’s digital commerce landscape.

To learn more about how PayPal can support your enterprise, click here.

1 FIS Worldpay (2021) , The 2021 Global Payments Report,

https://worldpay.globalpaymentsreport.com/

2 Global Newswire (2021), Study: More than half of the world’s population will use mobile wallets by 2025, https://www.globenewswire.com/en/news-release/2021/07/08/2259605/0/en/Study-More-than-half-of-the-world-s-population-will-use-mobile-wallets-by-2025.html

3 FIS Worldpay (2021), The 2021 Global Payments Report,

https://worldpay.globalpaymentsreport.com/

4 Capgemini (2021), World Payments Report 2021, https://worldpaymentsreport.com/

5 Yahoo!Finance (2021), Global Mobile Payment Methods 2021 Post COVID-19,

https://finance.yahoo.com/news/global-mobile-payment-methods-2021-082800946.html

6 Capgemini (2021), World Payments Report 2021, https://worldpaymentsreport.com/

7 McKinsey (2020), US digital payments: Achieving the next phase of consumer engagement, https://www.mckinsey.com/industries/financial-services/our-insights/banking-matters/us-digital-payments-achieving-the-next-phase-of-consumer-engagement

8 PYMNTS.com (2021), Deep Dive: How BNPL Solutions Are Answering Gen Z’s And Millennials’ Financial Needs, https://www.pymnts.com/buy-now-pay-later/2021/millennials-gen-z-retail-shopping-payments-habits/

9 Capgemini (2021), Payments Top Trends 2022,

https://www.capgemini.com/resources/top-trends-in-payments-2022/

10 Capgemini (2021), Payments Top Trends 2022,

https://www.capgemini.com/resources/top-trends-in-payments-2022/

11 Mercator Advisory Group (2020), Are you maximising your revenue potential?,

https://www.paypal.com/hk/brc/article/enterprise-solutions-mercator-study

12 Baymard Institute (2021), 44 Cart Abandonment Rate Statistics,

https://baymard.com/lists/cart-abandonment-rate

13 Center for Strategic & International Studies (2020), The Hidden Costs of Cybercrime,

https://www.csis.org/analysis/hidden-costs-cybercrime

14 CNBC (2021), Rise in online payments spurs questions over cybersecurity and privacy,

https://www.cnbc.com/2021/07/01/new-digital-payments-spur-questions-over-consumer-privacy-security-.html