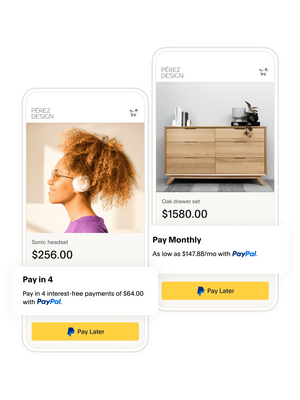

Shoppers are presented with a Pay Later offer

Dynamic messaging will automatically show the appropriate Pay Later offer: Pay Monthly7 or Pay in 48

They choose Pay in 4

Customers make a down payment and then pay the balance in three bi-weekly, interest-free payments. You’ll get paid in full upfront.

Or they choose Pay Monthly

Customers apply and know within seconds if they’re approved for monthly payments at varying APRs. You’ll still get paid in full.

Easy to pay and manage

Payments can be made automatically. Customers can review plan details online or in the app.