Automatically show customers Pay Later offers

Turn browsers into buyers with dynamic messages throughout the shopping journey.

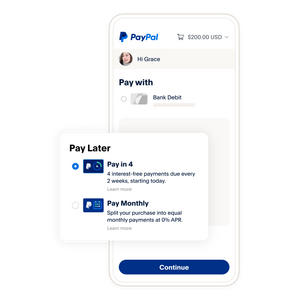

Customers choose Pay in 4

They can apply for Pay in 4 with no impact to their credit score.1

They review their payment schedule

If approved, the first of four equal interest-free payments is paid at purchase. The rest of the payments will be paid automatically on a predictable schedule.

We make it easy to track payments

Customers can make a payment and review plan details at any time in the PayPal app.