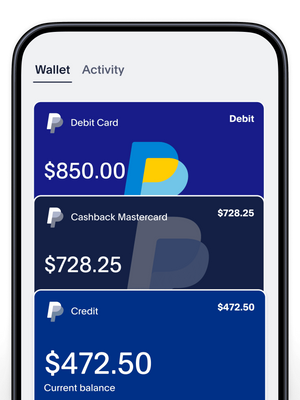

PayPal Cards and Credit Products

More ways to pay your way.

Finance your purchases with one of our flexible credit products. Or use money from your PayPal Balance account with the PayPal Debit Card.

PayPal Credit

Buy now, pay over time

Get No Interest if paid in full in 6 months on every purchase of $99+ everywhere PayPal is accepted.1 Plus, no impact to your credit score if declined.2

It’s in the app

Get the flexibility of managing your PayPal Credit account any time, anywhere.

Millions of online stores

Use it anywhere PayPal is accepted.

Always-on credit line

PayPal Credit is a reusable, digital credit line with no annual fee.3

PayPal Cashback Mastercard®

Earn unlimited 3% cash back on your PayPal purchases.4 And 2% cash back everywhere else Mastercard is accepted. No category restrictions, no limits. Plus, no impact to your credit score if you're declined.5

Redeem rewards now

Cash back is earned daily on completed purchases posted to your account. Redeem to your PayPal balance6 and spend it however you want.

Enjoy more flexibility

This card has no annual fee,7 no limits on how much you can earn, and no rotating categories.

Mastercard security

With the Mastercard ID Theft Protection™ benefit, you will be alerted to possible identity theft.8

PayPal Debit Card

This debit card makes earning rewards and managing your money easy.9

Shop

Use it in store or online everywhere Mastercard® is accepted.

Withdraw

Get cash globally, plus no-cost withdrawals at thousands of US MoneyPass® locations.11

No monthly fee

There’s no minimum balance or credit check to worry about.9

PayPal Prepaid Mastercard®

Take control of your cash flow with a secure prepaid card without overdraft fees.12

Frequently asked questions

Discover more ways to pay

Trust the way you pay

Easily and securely spend, send, and manage your transactions—all in one place. Download the app on your phone or sign up for free online.

Scan the code or enter your number to get the app.