Download the PayPal Pay Later strategy for Enterprises e-book

Learn more about all the growth opportunities brought by BNPL and PayPal's Pay Later offering and get ready to give more payment choices for your customers. Download our new report today.

PayPal Pay Later is available in the most competitive markets in the world and comes at no extra cost for your business.

Find out more

By offering the choice of payment in installments, you're empowering your customers with more flexibility to make purchases. They can pay over time interest-free (in selected countries) while you can see higher sales and more repeat business.

Pay Later enables shoppers to make purchases in interest-free payments in the US, UK, France and Australia. Businesses pay no additional costs, so it helps increase revenue without increasing marketing costs.

PayPal Pay Later is already built into PayPal Checkout, so it's easy to set up our ready-to-display messaging on your site.

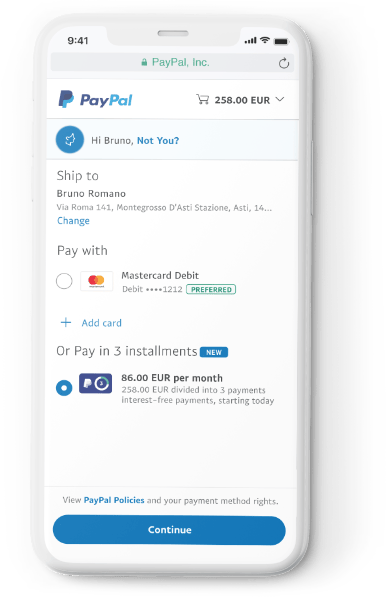

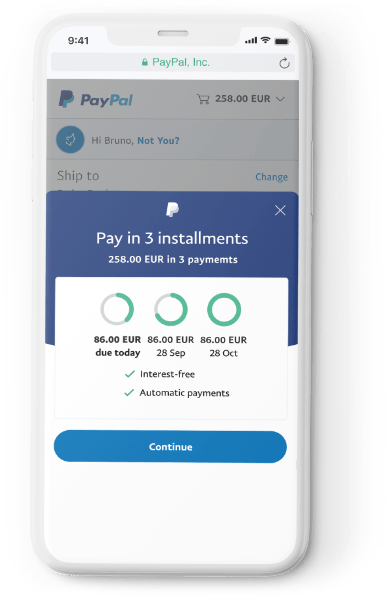

PayPal Pay Later helps your customers to buy what they want and pay over time.

Your customer sees their payment schedule. And there is no interest or sign up fees for their purchase of your business.

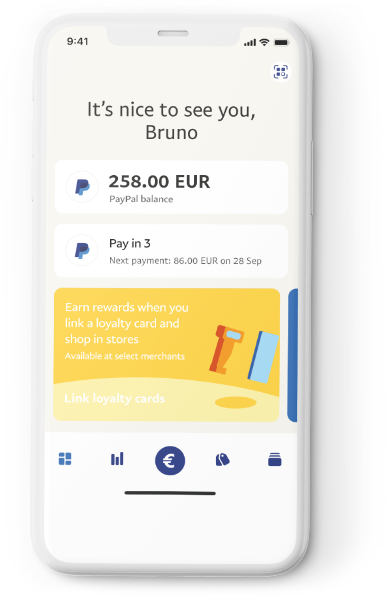

Once the order is processed, you get paid upfront. Then we take care of collecting the installment payments from your customer - the first at checkout.

PayPal Pay Later is already built into PayPal Checkout, so it's easy to set up our ready-to-display messaging on your site.

PayPal Pay Later helps your customers to buy what they want and pay over time.

Your customer sees their payment schedule. And there is no interest or sign up fees for their purchase of your business.

Once the order is processed, you get paid upfront. Then we take care of collecting the installment payments from your customer - the first at checkout.

Learn more about all the growth opportunities brought by BNPL and PayPal's Pay Later offering and get ready to give more payment choices for your customers. Download our new report today.

To learn more about how PayPal Pay Later can help transform your payment experiences, contact our sales team today.

Contact Us

**About Pay In 4 (US): Loans to California residents are made or arranged pursuant to a California Finance Lenders Law License. PayPal, Inc. Is a Georgia Installment Lender Licensee, NMLS #910457.

(1) An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39.

(2) Requires latest PayPal JS SDK integration.

(3) An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 U.S. online shoppers ages 18-39.

(4) An online study commissioned by PayPal and conducted by Atomik Research in May 2021 involving 2,007 U.S. shoppers ages 18-40.

(5) PayPal data analysis May 2021

(6) PayPal Q2 2021 Earnings Call, July 2021