Frictionless Commerce: Two Factors That Impact Sales

Seamless and secure online checkout is key to conversions

Online shopping has changed the way we buy – and it’s also changed the way we pay. Consumers no longer hand over cash to make a purchase. Instead, they choose from any number of payment methods and hand over sensitive personal data. They no longer have to wait in lines at the register, so they expect quick, convenient checkout. It’s all part of the frictionless commerce equation. Enterprise merchants who can solve this equation will deliver an experience that can keep customers coming back.

Mastering frictionless commerce and giving consumers what they want can be the difference between a conversion and an abandoned cart. But what does friction-free checkout look like? From the consumer’s point of view, it means a simple, intuitive experience that makes it easy to pay. For the enterprise, it means having the security features they need to protect data, fight fraud, and help increase customer trust and LTV.

Taken together, simplicity and security can have a major impact on conversions. Let’s break down these two must-haves even further – and solve the frictionless commerce equation.

Simplicity: Making online checkout seamless

Due to COVID-19, the shift from purchasing goods in physical stores to online has accelerated – with 62% of internet purchases made in Latin America were paid for using digital payment methods.1

As consumer preferences change, one thing stays the same: The secret to improving online sales is through simplicity.

The behaviour scientists at the Stanford Persuasive Tech Lab created the Fogg Behavior Model to show how technology design can change people's behaviours. For a behaviour to occur, one of the key elements is simplicity. The easier an action is to take, the less motivated the customer needs to be to take that action.

What does that mean for an enterprise merchant?

Simplicity is synonymous with seamlessness. Consumers don’t want to waste time figuring out how to pay. From desktop to tablet to smartphone, they want intuitive design, fewer clicks, and easy payment options that don’t send them running for their wallets to type in credit card numbers.

PayPal Complete Payments for Enterprise makes it easy to design and optimize your checkout experience across channels and devices. As one of the world’s leading payments platforms, PayPal offers digital wallets, credit and debit cards, and alternative payment methods – allowing your customers to choose their preferred way to pay and in turn, making it easier for them to complete their online purchases. And with PayPal One Touch, enterprises reduce clicks to checkout to just one – allowing for a seamless checkout process.

Security: Prioritizing data and fraud

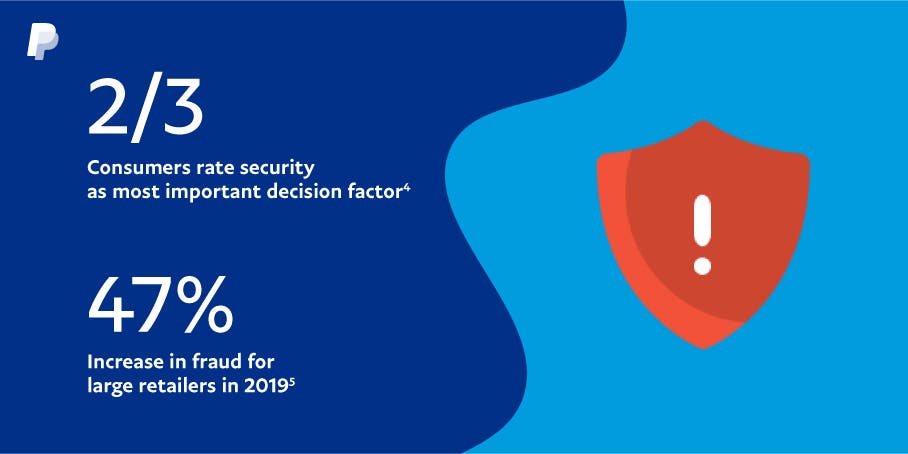

Customer trust is essential to any online business – and data security is its foundation. Two-thirds of consumers say security is the most important factor when deciding whether to interact with a business.2 But security is only part of the equation. Enterprises also need to protect themselves from rising fraud – some of these attempts to defraud businesses include:

- Chargebacks - leads to additional fees, loss of inventory, services, and can even lead to them not being able to accept a specific type of credit card.

- Credential Stuffing - The use of mass login attempts to verify the validity of stolen username/password pairs

- Account Takeover (ATO) – Using unauthorized access to an account belonging to someone else, usually prevalent in gaming, technology where instantaneous approvals of transactions are needed

The right features can help fight fraud while improving authorization rates and can increase trust and loyalty by creating a secure customer checkout experience.

PayPal Complete Payments for Enterprise’s advanced Fraud Protection technology uses an adaptive predictive risk algorithm to help spot fraud while allowing legitimate transactions. PayPal’s fraud detection and monitoring are 24/7 and every transaction is monitored for fraud. Enterprises could see higher auth rates and lower fraud losses.

We also provide automated tools to help you manage chargebacks, retrievals, and pre-arbitrations at scale without the need for additional integrations. And we use the latest security protocols like network tokenization and encryption to help you fight fraud.

Payment processing should enhance the shopping experience, not interfere with it. Every part of the process, from the shopping cart to the back end, can be used to help drive conversions. With PayPal Complete Payments for Enterprise, it’s easier than it seems. Learn how we can help enterprises navigate the new era of payments and start their journey toward frictionless commerce here.

Sources:

1 Worldwide; March 12 to 14, 2020; 10,000 respondents; 16-74 years; Online survey, Statista 2021

2 The 2020 Global Identity and Fraud Report, Experian, 2020.

We’ll use cookies to improve and customize your experience if you continue to browse. Is it OK if we also use cookies to show you personalized ads? Learn more and manage your cookies